There's no better way to understand how borrowers behave when servicing a facility than using analytics. Facilities such as consumer loans and many other categories of unsecured loans are considered to have a higher rate of default than secured loans. Effective monitoring of these loans ensures that the lending organisation is better off lending than investing for that period and it keeps track of borrower’s timely repayment of facilities.

Lending organisations need a reliable measurement technique in order to stay well-informed on their loan market share, the performance of existing loans, and when to give or stop disbursement of loans. The organisation needs to know where they stand in terms of liquidity, poor loans, and high performing loans. This task can be quite demanding and daunting, but it still remains a crucial aspect of the business. With insights gained from these measurements, smart decisions can be made to better drive business growth and reduce losses.

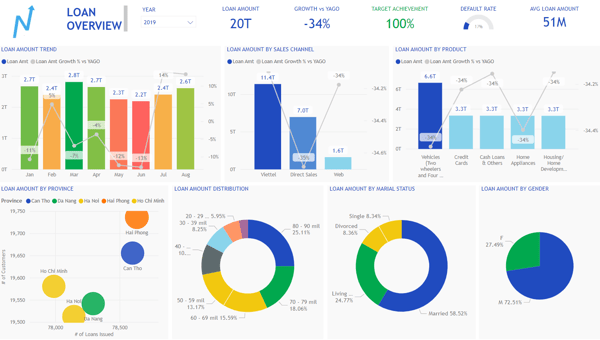

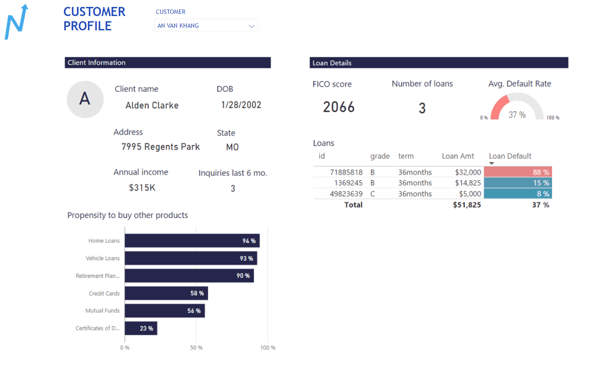

Take a look at this Consumer Loan Performance designed by Just Analytics. This dashboard helps organisations stay on top of their lending business. As shown in the image below, this consumer loan performance analytics provides organisations with access to not just all disbursed loans in their organisation, but also a holistic view of each individual borrower. These dashboards explain via charts and bars all the essential information on the data being analysed. At a glance, crucial information can be gleaned from this dashboard, thereby making the decision-making process easier for management.

Additionally, organisations can dive deep into how the individual has behaved in the past with regards to their credit history, giving you insights into the credit habits of borrowers. In return, this will empower organisations to make the right decisions of whether to loan or not to loan.

By and large, being able to deploy these analytics tools to effective use depends on a good understanding of their unique values. The following are some unique characteristics of Just Analytics’ Consumer Loan Performance dashboard:

1. Chock full of rich insights

It provides rich insights into the borrowing history of each potential/current individual. Although analysis typically reviews all customer data, this can be done by highlighting just one individual. This is a way to judge how the individual is performing on the current loan compared to their performance on previous facilities.

2. Comprehensive data

With an interactive overview of all running facilities, this dashboard allows a quick overview of all loans, which can further be categorized based on groups such as gender, age, location, or marital status depending on the criteria of interest.

3. Easy-to-read dashboard

Like our other business analytics solutions, they are easy to use and understand. It completely eliminates the need to deal with unending rows and columns of data, while making sense of existing data for business growth. The data is colour-coded accordingly, thereby supporting your visualisation of the data in an easily interpretable manner.

Does this sound like something your firm will be interested in? Get in touch with us at for a complimentary discovery session to find out more about how we can help you reach your goals and objectives.