![]()

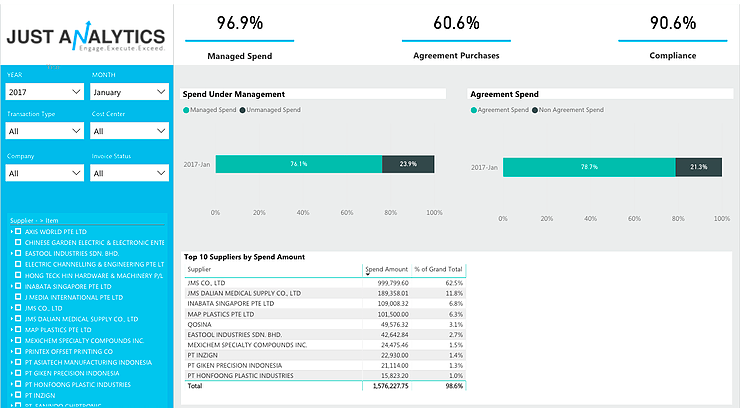

With the advent of smarter spend management systems, a lot of companies have managed to improve their procurement processes over the last decade. A recent study by leading industry analysts states that “Spend under Management” ranges from 66% for the average company to 89% for the best in class. Yet, if your company is still processing vendor invoices manually, you are spilling money out of your organization. It is shocking to see the amount of cash even a small organization can lose when you consider lost rebates, false bills and an extended payables cycle.

Despite having requisition processes, approval workflows and vendor contracts in place, many businesses receive a large number of Non-PO invoices. Some examples are emergency spending, legal services, facility services, repairs and taxes. These Non-PO invoices fall under Accounts Payable and are circulated to the authorized approvers by email or through paper files. Some typical pain points when processing Non-PO invoices are:

1. Manual approval processes for Non-PO invoices lead to a lot of misplaced invoices, resulting in late payment charges or lost discounts.

2. It takes a lot of time to enter and track the invoices.

3. Sometimes the organization might fail in correcting the discrepancies in the invoice.

4. While performing an audit, there is no historical record of these invoices.

Handling the movement of paper invoices through the approval process becomes challenging as well as time consuming. As payables play a vital role for planning, arranging and cash forecasting, issues in the process can make it very difficult for the AP department to report in real-time. Hence it becomes extremely necessary to have an automated AP department. This is where analytics and our ERP solution can help.Want to see how it works? Here's our Financial Demos.

Our solution focuses on eliminating cash leaks by analyzing Non-PO transactions and identifying lost discounts. It eliminates the use of paper invoices thus bringing quality across the entire cycle. Using forecasting techniques, we can also manage and track the extended payables by offering direct control of the entire workflow. This results in increased visibility and profitability.