We live in an age where the consumer is king. Organizations around the globe are now heavily investing both time and money on solutions that will help them attract and engage customers. But not all customers are equal. While all must be treated right, some will need to be given even better treatment. These select customers are your more valuable ones, those who will give you higher profits during the course of their relationship with you

So how do you identify which customers are more important? One way is by treating your customer relationship as a company asset and putting an actual value on it. Customer Lifetime Value or CLV represents the total net profit your company makes from a customer. It is, by definition, a way to estimate your customer’s monetary worth to you, after factoring in the value of the relationship over time. This means looking not just at customer purchases and the margins you get from it but adding in the cost of acquiring or retaining a customer to the equation.

Let’s say Sherlock Holmes and John Watson are both subscribers to your credit card company. Both decided to become customers after seeing your digital ad on the internet. Sherlock is a frequent shopper and uses his credit card extensively for most of his purchases. John is a bit more reserved when it comes to spending. He uses his card only once a month and purchases are low. Your cost for acquiring them as customers is the same. But given Sherlock’s spending habits, you get more profit from him. He then has a higher CLV compared to John.

But can you, in fact, find ways to get more profit from your customers and improve their CLV?

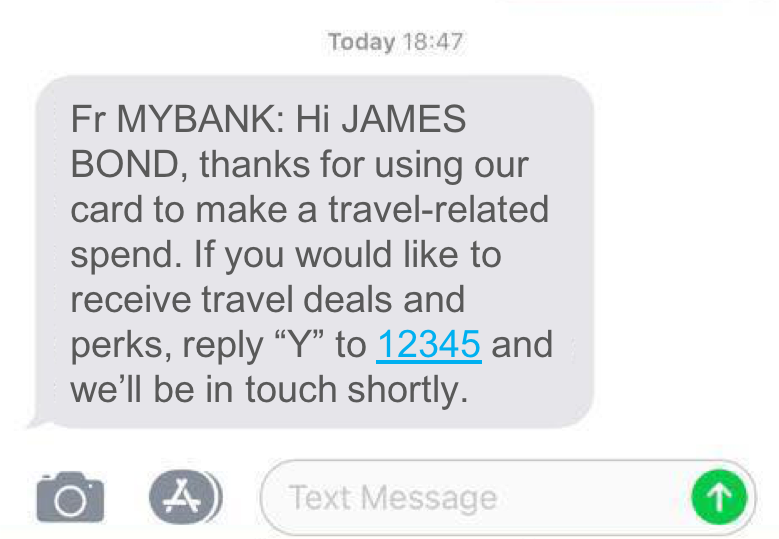

Consider this scenario: James Bond saw your credit card ad while browsing the internet. This led him to apply for a credit card. Over the course of time, you notice that he sometimes uses his card to purchase airline tickets at certain times of the year. With this insight, you decide to send him a personalized email every quarter that showcases your travel promos. As a result, he then starts using his card more often for his travel, not just for airline tickets but hotel accommodations and even F&B.

So, is James now a more valuable customer given that he uses his credit card more frequently? If the profit you get from James is higher than the costs to retain him (e.g. cost of quarterly email), then the answer would be a resounding yes --- James has now become a more valuable customer. To see a summarized version of this scenario along with a shortened version of the working code, please have a look at our notebook on CLV. To get a detailed view of the code, you may want to have a look at our GITHUB code repository.

To easily determine your customers’ CLV and more importantly, recommend ways to increase their value, the use of analytics is key. Just Analytics’ AI for Banking solution provides a way for organizations to identify your most important customers and provide insights to help you capture more value from each customer. Through this solution, credit card companies can: 1) easily profile new customers and peg their optimal acquisition and retention costs; 2) predict future transactions for existing customers; 3) predict customer churn or how long you are most likely to retain each customer; and 4) drive recommendations to customers that influence them to increase credit card usage, thus helping improve their CLV.

Want more info?Make sure you contact us for these trending topics and more.